The Freedom and Responsibility of Self-Direction in Real Estate

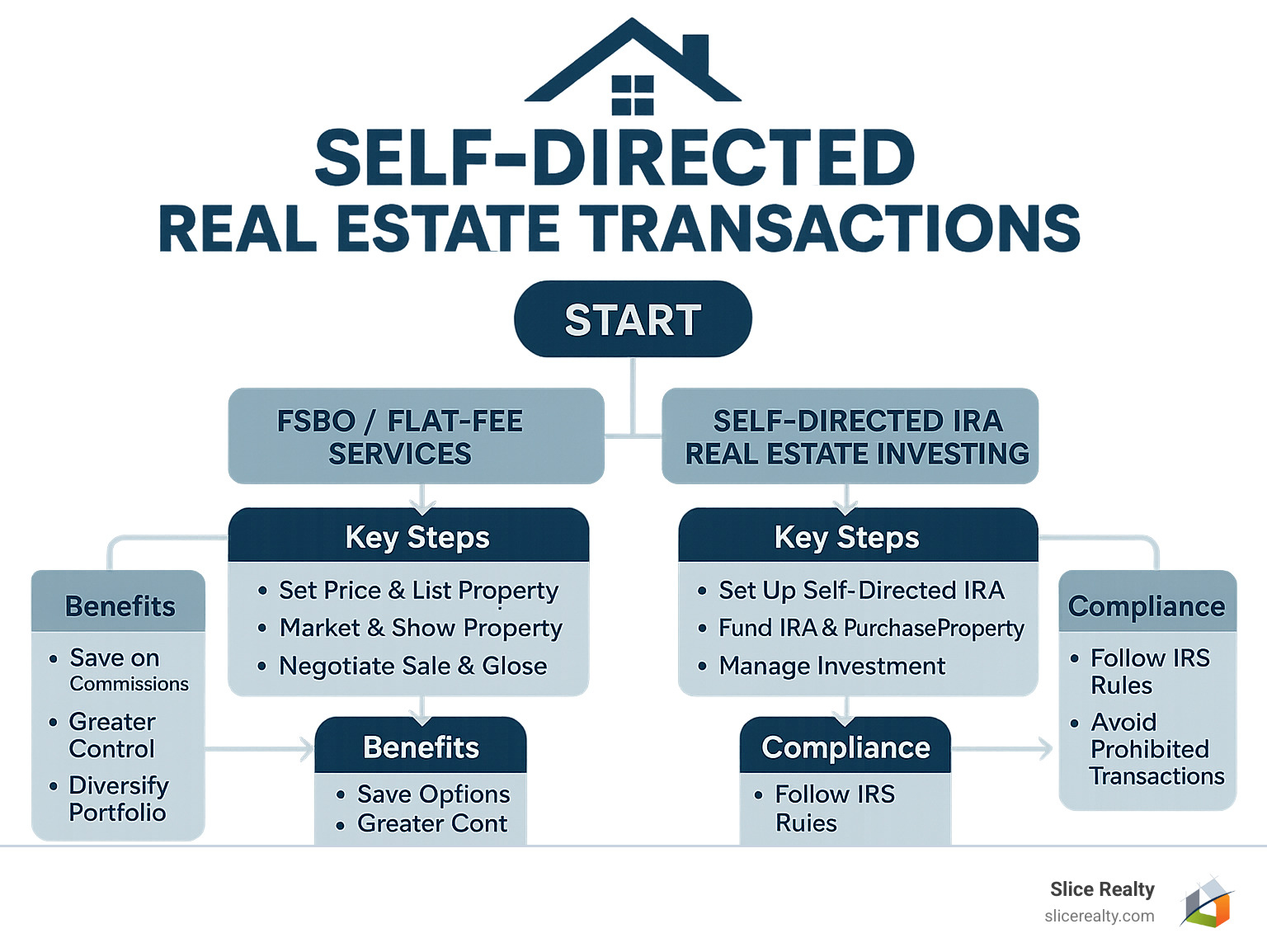

Self-directed real estate transactions refer to the process of buying or selling property with minimal or no agent involvement, or using retirement accounts like self-directed IRAs to invest in real estate. Here’s what you need to know:

- Definition: Transactions where you take control of the buying/selling process or use retirement funds to invest in property

- Two Main Types:

- Agent-free transactions (FSBO, flat-fee MLS)

- Self-directed retirement account real estate investments

- Key Benefits: Save thousands in commissions, greater investment control, portfolio diversification

- Main Challenges: Navigating legal requirements, avoiding prohibited transactions, managing paperwork

When done correctly, self-directed real estate transactions can save you significant money while giving you greater control over your investments or property sales.

Real estate transactions don’t have to be complicated or expensive. Whether you’re looking to buy or sell property without traditional agent commissions, or you’re interested in using retirement funds to invest in real estate, taking a self-directed approach can offer significant benefits – along with important responsibilities.

Our average seller at Slice Realty walks out of closing with a check over $8,000 larger than if they sold with a traditional agent. For retirement investors, self-directed IRAs offer access to real estate investments that traditional accounts simply don’t allow, creating opportunities for diversification and potentially higher returns.

But self-direction comes with rules. From navigating IRS regulations for retirement investments to handling contracts and disclosures in agent-free transactions, understanding the legal framework is essential for success.

I’m Tommy Lorden, Managing Broker and founder of Slice Realty, where I’ve helped hundreds of clients steer self-directed real estate transactions since 2009, combining my legal background with innovative real estate solutions that empower buyers and sellers to take control of their property deals.

Why This Guide Matters

Taking control of your real estate transactions means more than just saving money—though that’s certainly a compelling reason. Our clients consistently save thousands by handling aspects of their transactions themselves, with professional support exactly where they need it.

This guide matters because:

- Portfolio Control: You deserve to direct your investments according to your expertise and interests

- Cost Savings: Traditional 6% commissions can amount to tens of thousands of dollars on a single transaction

- Rule Clarity: Understanding the legal framework keeps you compliant and protects your investments

Whether you’re an experienced investor looking to diversify your retirement portfolio with real estate or a homeowner wanting to maximize your proceeds when selling, we’ve created this guide to explain the process and help you steer the complexities with confidence.

What Are Self-Directed IRAs? Foundation of Self-Directed Real Estate Transactions

Think of a self-directed IRA as your retirement account with the training wheels taken off. Unlike traditional IRAs that limit you to a menu of stocks and bonds, self-directed IRAs let you grab the handlebars and steer your retirement funds toward alternative investments – with real estate being the star of the show.

These accounts have actually been around since 1975, following the passage of ERISA (Employee Retirement Income Security Act) in 1974. What makes them “self-directed” isn’t that you physically hold the assets (you don’t), but rather your freedom to point your retirement dollars toward investments you understand and believe in.

A crucial point to remember: while you make the investment decisions, a qualified custodian must hold the assets. Think of them as your financial referee – they don’t coach your investment strategy, but they do make sure you’re playing by the rules.

| Feature | Traditional IRA | Self-Directed IRA |

|---|---|---|

| Investment Options | Typically limited to stocks, bonds, mutual funds | Wide range including real estate, private equity, precious metals |

| Custodian Role | Investment management and administration | Administrative only; no investment advice |

| Contribution Limits (2025) | $7,000 ($8,000 if 50+) | Same as Traditional: $7,000 ($8,000 if 50+) |

| Tax Treatment | Tax-deferred or tax-free (Roth) | Same tax advantages as Traditional |

| Required Custodian | Yes | Yes, specialized SDIRA custodian |

| Checkbook Control Option | No | Yes, through LLC structure |

| Prohibited Transactions | Few concerns with standard investments | Significant rules regarding disqualified persons |

With this freedom comes responsibility. The IRS isn’t so concerned about what you invest in as much as who you’re doing business with and how you benefit from those investments.

1. Self-Directed IRA vs Traditional IRA

Both types of IRAs offer the same delicious tax benefits – your investments grow either tax-deferred (traditional) or tax-free (Roth). The real difference is in what you can put on your investment plate.

Traditional IRAs typically serve up a limited menu:

– Stocks and bonds

– Mutual funds

– CDs and money market accounts

– ETFs

Self-directed IRAs offer the full buffet:

– Real estate (from single-family homes to commercial properties)

– Private businesses

– Tax lien certificates

– Precious metals

– Private lending

– And a whole lot more

Setting up a self-directed IRA requires finding a specialized custodian who understands alternative assets. While you can open a traditional IRA at nearly any bank or brokerage, self-directed accounts need custodians specifically equipped to handle these unique investments.

The good news? Your contribution limits stay exactly the same. For 2025, you can contribute up to $7,000, or $8,000 if you’re 50 or older – just like with traditional IRAs.

2. Allowed Real Estate Asset Types

When it comes to real estate in your self-directed IRA, the options are refreshingly broad. Industry experts estimate that about 25% of all self-directed IRA assets are invested in real estate – and for good reason. It’s tangible, understandable, and offers both income and growth potential.

Your self-directed real estate transactions can include:

Residential Properties – From cozy single-family homes to multi-unit apartment buildings, these can generate steady rental income while potentially appreciating over time.

Commercial Properties – Office buildings, retail spaces, and warehouses often come with longer leases and potentially higher returns.

Raw Land – Undeveloped parcels can be held for appreciation or future development. They typically require less maintenance but generate no immediate income.

Real Estate Notes – Rather than owning property directly, you can be the bank by financing others’ real estate purchases.

REITs and Crowdfunding – If you prefer not to manage properties directly, you can invest in real estate investment trusts or crowdfunding platforms that offer fractional ownership.

Tax Liens and Deeds – These property-secured tax debt investments can yield attractive returns when handled properly.

3. Disallowed Assets & Disqualified Persons

While the IRS gives you plenty of investment freedom, they do draw some clear boundaries. Understanding these limits is essential to keep your retirement account healthy and compliant.

First, let’s talk about what you can’t invest in:

Collectibles are a big no-no – that includes art, rugs, antiques, most metals (except certain approved precious metals), gems, stamps, most coins, alcoholic beverages, and other tangible personal property.

Life insurance contracts can’t be held in your IRA – period.

S-Corporation shares are off-limits for IRAs due to ownership restrictions.

Even more important than what you invest in is who you do business with. The IRS strictly prohibits transactions with “disqualified persons” to prevent self-dealing. This is where many well-intentioned investors stumble.

Disqualified persons include you (the IRA owner), your spouse, your lineal family members (parents, children, grandchildren, etc.), their spouses, investment advisors, and any entity where disqualified persons own 50% or more.

What does this mean in practice? You can’t use your IRA to buy a property from your parents. Your IRA can’t sell a property to your daughter. You can’t even rent a property owned by your IRA to your son. The rules are detailed in IRC Section 408.

Breaking these rules isn’t just a minor oops – it could result in your entire IRA being disqualified and treated as distributed, triggering taxes and penalties. That’s why having professional guidance through these waters is so valuable.

The IRS Rulebook: Prohibited Transactions, Compliance & Penalties

If there’s one thing to understand about self-directed real estate transactions within your IRA, it’s this: the IRS cares less about what you invest in and more about who you’re dealing with and how you benefit. Think of these rules as guardrails designed to keep your retirement account actually working for your retirement—not as a piggy bank for today.

The penalties for stepping outside these guardrails? Let’s just say they’re severe enough that you’ll want to pay close attention. I’ve seen investors lose their entire tax-advantaged status over simple mistakes that could have been avoided.

1. Who Counts as a Disqualified Person?

The IRS has drawn a clear family circle around who can’t participate in your IRA’s real estate deals. Section 4975 of the Internal Revenue Code spells it out:

Your IRA can’t do business with you (the owner) or your spouse—that’s the inner circle. It also can’t transact with your parents, grandparents, children, or grandchildren (or their spouses). Think of it as a vertical family tree—anyone directly above or below you is off-limits.

Interestingly, siblings, cousins, aunts, uncles, and in-laws (except those married to your descendants) are actually fair game. The IRS also considers certain business relationships disqualified—including fiduciaries advising your IRA, service providers, and entities where disqualified persons own 50% or more.

2. Prohibited Deal Structures & Consequences

When it comes to what your IRA can’t do, there are three main danger zones to avoid:

Direct dealings between your IRA and anyone on the disqualified list—this includes buying, selling, leasing, lending, or providing services. For example, your IRA can’t buy a rental property from your parents or hire your daughter to manage it.

Credit extensions are another no-go. You can’t personally guarantee a loan for your IRA’s real estate purchase or use IRA assets as collateral for a personal loan.

Self-dealing is perhaps the most tempting trap. That beach house your IRA bought? You can’t use it for a family vacation—not even for a weekend. Your IRA’s investments must benefit the IRA alone, not provide current perks to you or your family.

The consequences? If you (as the IRA owner) cross these lines, the IRS considers your entire IRA distributed as of January 1st of the violation year. That means taxes due on the full amount, plus potential early withdrawal penalties if you’re under 59½. If another disqualified person commits the violation, they face a 15% excise tax that can rocket to 100% if not promptly corrected.

3. Annual & Event-Driven Duties

Keeping your self-directed real estate transactions compliant isn’t a one-and-done affair—it requires ongoing attention.

Every year, your IRA custodian must report the fair market value of all assets to the IRS via Form 5498. If your property generates certain types of income (more on UBTI later), you’ll need to file Form 990-T. And remember—every single property expense, from property taxes to that emergency plumbing repair, must be paid from IRA funds, often using tools like the STRATA Expense Authorization form.

Beyond these annual requirements, certain events trigger additional duties. Buying or selling property? You’ll need an appraisal. Converting to a Roth IRA or taking an in-kind distribution? Same thing. And throughout it all, meticulous record-keeping is essential.

The golden rule is to treat your IRA as completely separate from yourself. Every dollar in and every dollar out must flow through the IRA, with absolutely no commingling with your personal funds. I’ve seen too many investors slip up by paying a small repair bill from their personal account “just this once”—only to find themselves facing serious consequences.

With careful attention to these rules, your self-directed IRA can be a powerful vehicle for building wealth through real estate while maintaining its valuable tax advantages.

Step-by-Step Guide to Self-Directed Real Estate Transactions

Ready to put your retirement funds to work in real estate? Let’s walk through exactly how this process unfolds. I’ve guided hundreds of investors through these steps, and while it might seem complex at first, breaking it down makes it much more manageable.

Opening & Funding the Account

First things first – you’ll need the right financial vehicle for your investment. Think of this as creating a special container that will hold your real estate assets.

Start by selecting a custodian who specializes in self-directed accounts. Companies like Equity Trust, STRATA Trust, and Directed IRA have built their businesses around alternative investments. They understand real estate transactions and won’t give you the confused looks you might get at traditional brokerages.

When completing your account application, you’ll choose between a Traditional IRA (giving you tax breaks now) or a Roth IRA (giving you tax-free growth later). This decision should align with your broader tax strategy – something worth discussing with your tax advisor before diving in.

Now comes the money part. You have three main ways to fund your new account:

Through a transfer from an existing IRA (the simplest option with no tax implications), via a rollover from your employer plan like a 401(k) (also tax-free if done correctly), or through annual contributions (limited to $7,000 in 2025, or $8,000 if you’re 50+).

Be patient during this phase – transfers and rollovers typically take 5-10 business days. I’ve seen eager investors find the perfect property only to miss out because their funds weren’t ready. Plan ahead!

Making the Offer & Closing

With your funded account ready to go, it’s time for the exciting part – finding and purchasing your investment property.

When you identify a promising property, your IRA is the actual buyer, not you personally. This distinction is crucial. Your purchase contract must list the buyer as: “[Custodian Name] as Custodian FBO [Your Name] IRA #[Account Number]”

Once you’ve got a signed contract, submit it to your custodian for review. They’ll verify everything is compliant and send the earnest money deposit directly from your IRA funds. This is where patience comes in handy – custodial reviews typically take 2-3 business days.

During the due diligence period, arrange for inspections, appraisals, and title work – all paid for by your IRA, not your personal funds. This is a common mistake I see first-time SDIRA investors make. Even a small inspection fee paid from your personal account can create compliance headaches.

At closing, your custodian will review all documents and send the purchase funds. The deed must be titled in your IRA’s name using the format mentioned above. After recording, the deed gets sent to your custodian for safekeeping.

Throughout this process, you’re simply directing the transaction – your IRA is the actual buyer. This mental shift helps maintain proper compliance.

Managing Income & Expenses Inside the IRA

Once you own the property, proper management becomes essential for maintaining IRA compliance. The golden rule is simple: all money in and all money out must flow through your IRA.

Every rent check must be deposited directly into your IRA account – never into your personal bank account, even temporarily. Most custodians provide tenants with payment instructions, making this process relatively seamless.

For expenses, you have several options depending on your custodian:

You can submit Expense Authorization Forms along with invoices to your custodian, who will pay them from your IRA funds. Some custodians offer an Expense Pass Card – essentially a debit card linked to your IRA for more convenient expense management. For those seeking maximum control, a Checkbook Control structure using an IRA-LLC allows you to write checks directly from an LLC bank account.

Detailed record-keeping is your friend here. Create a system to track all income and expenses, with quarterly reviews to ensure everything balances. And if property management isn’t your strength, you can absolutely hire a property manager – just make sure they’re not a disqualified person (like your son or daughter).

For financed properties, all mortgage payments must come from the IRA, and you must use a non-recourse loan. We’ll dive deeper into financing in a later section.

Selling or Exiting the Investment

All good things eventually come to an end, and your real estate investment is no exception. When it’s time to sell, the process mirrors the purchase in reverse.

List the property with all documentation showing your IRA as the seller. When you accept an offer, your custodian must review and approve the sale agreement. At closing, the custodian will sign the necessary documents, and proceeds go directly into your IRA – not to you personally.

What happens next is up to you. You might reinvest those proceeds in another property or different asset type. Or perhaps it’s time to start taking distributions according to IRA rules.

Some investors explore alternative exit strategies like in-kind distributions (taking the property itself as a distribution, which triggers taxes and potential penalties), Roth conversions (moving from a Traditional to a Roth IRA by paying taxes on the conversion amount), or installment sales (selling with owner financing to create ongoing income for your IRA).

Each strategy has unique tax implications, so this is definitely a moment to consult with a qualified tax advisor. At Slice Realty, our lawyer-led services can help steer these complex decisions to maximize your investment outcomes.

The beauty of self-directed real estate transactions is the control they offer – but with that control comes responsibility. Following these steps carefully ensures your retirement investment remains compliant while working hard for your future.

Financing, Income Handling & Taxes

Let’s talk money—specifically, how to fund, manage, and steer the tax implications of your self-directed real estate transactions. This is where many investors get tripped up, but with the right approach, you can turn these complexities into opportunities.

1. Non-Recourse Loans Explained

When your IRA buys property, it can’t just walk into any bank and get a traditional mortgage. Instead, you’ll need a non-recourse loan—a special financing arrangement where the property itself is the only collateral. If things go south, the lender can take the property but can’t come after you or your IRA for any shortfall.

Think of it as “the property stands on its own merits” financing.

These loans come with some trade-offs: expect to put down 30-40% (versus the typical 20% for conventional loans), pay interest rates about 1-2% higher than market rates, and face stricter qualification criteria focused on the property’s income potential rather than your personal finances.

Finding these specialized lenders takes a bit more legwork. Institutions like First Western Federal Savings Bank, North American Savings Bank, and IRA Lending Trust have developed expertise in this niche. Despite the higher costs, non-recourse financing can be a powerful tool to amplify your retirement investments, allowing you to control more valuable properties than you could with cash alone.

2. UBTI & UDFI: What You’ll Owe and When

Here’s where things get interesting—and a bit more complicated. When your IRA uses debt to buy property, Uncle Sam wants his cut through something called Unrelated Business Taxable Income (UBTI) and Unrelated Debt-Financed Income (UDFI).

The math is actually straightforward: the percentage of your property purchased with borrowed money determines the percentage of income subject to these taxes.

For example, if you buy a $100,000 property using $40,000 from your IRA and a $60,000 loan, 60% of your rental income and appreciation would be subject to UBTI/UDFI taxes. These are reported on IRS Form 990-T and taxed according to trust tax rates, which climb steeply.

For 2025, you’re looking at:

– 10% on the first $2,550

– 24% on income between $2,551 and $9,150

– 35% on income between $9,151 and $12,500

– 37% on anything above $12,500

Yes, these taxes take a bite out of your returns, but don’t let them scare you away from leveraging your IRA. Even after taxes, the improved returns from a well-selected, financed property can significantly outpace what you’d earn with a cash-only approach.

3. Cash Flow Management Best Practices

Managing cash flow for IRA-owned real estate isn’t just good business—it’s essential for staying compliant with IRS rules. The golden rule: your IRA must have enough money to handle all property-related expenses without any help from you personally.

Keep healthy reserves in your IRA account—most experienced investors maintain liquid funds equal to 20-30% of the property’s value. This cushion protects you from having to scramble when the furnace dies in January or when your tenant suddenly moves out.

Implement quarterly accounting to track everything coming in and going out. This isn’t just about staying organized; it’s about spotting trends before they become problems. Are expenses creeping up? Is rent collection becoming irregular? Catching these issues early gives you time to course-correct.

Accept digital tools for payment management. Most custodians offer online portals, virtual cards, and automatic payment systems that streamline expense handling. These tools create clear documentation trails that prove invaluable during IRS inquiries or when calculating UBTI.

Partner with a tax professional who understands the nuances of retirement account investing. They can help identify deductible expenses to offset taxable income, estimate quarterly tax payments if needed, and evaluate whether your current strategy is tax-efficient.

Running out of funds in your IRA can create a serious temptation to pay expenses from your personal accounts—which would constitute a prohibited transaction and potentially disqualify your entire IRA. Good cash flow management isn’t just about maximizing returns; it’s about protecting your retirement nest egg from costly mistakes.

DIY vs Professional Support: Closing Deals Without an Agent

Beyond retirement account investing, self-directed real estate transactions also encompass buying and selling property without traditional agent representation. This approach can save you thousands in commissions while giving you greater control over the entire process.

At Slice Realty, we’ve watched clients successfully steer this terrain with the right support, saving an average of $8,000 compared to traditional agent commissions. Let’s explore what this approach really means for you.

Benefits & Risks of Self-Representation in Self-Directed Real Estate Transactions

When you handle your own real estate transaction, you’re trading agent services for significant financial benefits. The most obvious advantage is cost savings – traditional commissions typically eat up 5-6% of your sale price, while our flat-fee services run just 1-3%, putting thousands back in your pocket.

You’ll also enjoy complete control over your transaction. There’s something empowering about negotiating directly with buyers or sellers without intermediaries filtering information. This transparency means you see all offers and communications firsthand, giving you clearer insights into what’s really happening.

The flexibility to set your own showing schedule, marketing approach, and negotiation strategy shouldn’t be underestimated either. Want to show your home at 8pm on a Tuesday? You can do that without coordinating with an agent’s calendar.

Of course, going solo isn’t without challenges. Compliance gaps can emerge if you miss required disclosures or legal documents, potentially creating liability down the road. Without MLS access, you might face limited exposure to potential buyers. Many sellers also struggle with emotional bias when negotiating their own property – it’s hard to stay objective about a home you’ve lived in for years.

And let’s be honest about the time commitment – managing showings, marketing, and paperwork requires significant hours that many busy professionals simply don’t have.

The good news? You can mitigate these risks with flat-fee MLS listings and targeted professional support right where you need it most.

Essential Documents & Tools for a DIY Closing

Successfully closing a self-directed real estate transaction without an agent requires having the right paperwork in place. Many successful investors tell us they prefer straightforward, repeatable templates rather than overly complex forms.

Your transaction toolkit should include a solid purchase agreement – the legally binding contract outlining all terms of the sale. You’ll need to verify clear title through a title search and obtain title insurance to protect against future claims. Services like DataTree can help with preliminary searches before you engage a title company.

Don’t forget state-required disclosure statements. In Colorado, sellers must complete a Seller’s Property Disclosure form detailing the property’s condition and any known issues. This transparency protects both parties and prevents future disputes.

The deed transfers actual ownership and comes in several varieties. A warranty deed provides the most protection for buyers, while a special warranty deed limits the seller’s liability to their period of ownership. A quitclaim deed simply transfers whatever interest the seller has, without warranties.

Your closing will also require supporting documentation like transfer tax declarations, municipal notification forms, and well/septic certifications if applicable. For tax purposes, you’ll need IRS Form 1099-S to report proceeds from the real estate transaction, along with a detailed settlement statement itemizing all financial aspects.

While online resources like Rocket Lawyer offer helpful templates, we strongly recommend having them reviewed by a real estate attorney to ensure compliance with Colorado law. Small oversights can create big headaches later.

When to Bring in a Real Estate Attorney or Flat-Fee Service

While DIY approaches work beautifully for straightforward transactions, certain situations absolutely warrant professional support. Trust your instincts – if something feels complex or unusual about your transaction, it probably is.

Consider professional help when dealing with complex zoning or land use issues that might affect property value or future use. Multi-party transactions involving partnerships or family members benefit from neutral third-party guidance to prevent misunderstandings.

Commercial properties typically involve more complicated contracts and disclosures than residential deals. Unusual financing arrangements like seller financing or assumption of existing loans require careful documentation to protect all parties.

If you find title defects or boundary disputes, professional expertise becomes invaluable in resolving these issues before closing. And generally speaking, any transaction involving high-value assets (over $10,000) deserves professional review simply because the stakes are higher.

At Slice Realty, we’ve designed our lawyer-led, flat-fee services to provide precisely the support you need without the traditional commission structure. Our approach combines legal expertise with real estate knowledge, giving you peace of mind while still saving thousands.

For experienced investors handling routine transactions, a simple document review may suffice. For more complex situations, our full-service representation ensures nothing falls through the cracks while keeping more money in your pocket.

Learn more about our Flat Fee Real Estate Colorado services

Avoiding Pitfalls: Common Mistakes & How to Dodge Them

Let’s be honest – even the savviest investors can stumble when navigating self-directed real estate transactions. After helping hundreds of clients through this process, I’ve seen some painful (and expensive) mistakes that could have been easily avoided with a little foresight.

Quick-Hit Mistake Checklist

I remember one client who nearly disqualified their entire $500,000 IRA by personally paying a $200 emergency plumbing bill for their IRA-owned property. They had no idea this simple act constituted a prohibited transaction that could have collapsed their retirement savings. These small oversights often create the biggest problems.

The most common pitfalls I’ve witnessed involve blurring the lines between personal and retirement assets. Your IRA-owned property isn’t yours to enjoy – it belongs to your retirement account. This means never staying overnight in your IRA’s beach condo, even if it’s vacant during your vacation. Similarly, never hire your handy son-in-law to fix the roof on your IRA’s rental property, no matter how reasonable his rates might be.

Another frequent misstep is poor cash flow management. Without adequate reserves in your IRA, you’ll face a serious dilemma when unexpected expenses arise: either commit a prohibited transaction by paying personally or watch your investment deteriorate. I recommend keeping at least 20-30% of your property’s value in cash reserves within your IRA.

The tax implications of leveraged real estate in IRAs catch many investors off guard. If your IRA uses financing to purchase property, you’ll likely need to file Form 990-T and pay UBTI taxes on the debt-financed portion of your income. Missing these filings can result in penalties that eat into your returns.

Property titling errors create headaches that can take months to resolve. Always ensure your properties are correctly titled as: “[Custodian Name] as Custodian FBO [Your Name] IRA #[Account Number].” Anything else could create legal complications down the road.

Many self-directed investors underestimate the importance of professional property management. While it’s tempting to save money by handling tenant issues yourself, this constitutes a prohibited service to your IRA. Instead, hire a reputable third-party manager with no relation to you.

Insurance oversights can be catastrophic. I’ve seen investors lose tens of thousands when inadequate coverage met unexpected disasters. Make sure your policies name the IRA as the insured party and provide comprehensive protection.

Meticulous record-keeping isn’t exciting, but it’s essential. Every expense, income item, and transaction should be documented and retained. This becomes particularly important if you’re ever faced with an IRS audit.

The DIY approach works wonderfully with the right knowledge and targeted professional support at key junctures. But attempting complex transactions without proper guidance often leads to costly mistakes that far outweigh any savings from avoiding professional fees.

At Slice Realty, we’ve helped countless investors steer these potential pitfalls with our lawyer-led approach. Sometimes all you need is a quick review of documents; other times, more comprehensive guidance proves invaluable. The key is knowing when to seek help and when you can confidently proceed on your own.

Frequently Asked Questions about Self-Directed Real Estate Transactions

What is a “self-directed real estate transaction”?

When people talk about self-directed real estate transactions, they’re usually referring to one of two approaches:

First, it’s buying or selling property without the traditional 5-6% agent commission structure. This might mean handling everything yourself (FSBO), or using flat-fee services like ours that provide targeted support at a fraction of the cost.

Second, it’s using retirement accounts like self-directed IRAs to invest in real estate, giving you access to alternative assets beyond the typical stocks and bonds.

Both paths share a common theme: taking greater control of your real estate dealings while potentially saving thousands of dollars. At Slice Realty, we’ve helped hundreds of clients steer both approaches since 2009.

Can I partner my IRA with personal funds or family members?

Yes, you absolutely can partner your IRA with other investors – but you’ll need to tread carefully here.

Your IRA can team up with non-disqualified persons (like your siblings, friends, or unrelated investors) without issue. You can even partner your IRA with your personal non-retirement funds, creating what’s called a tenancy-in-common ownership structure.

The key requirements are straightforward: establish the partnership from the very beginning of the purchase, divide all income and expenses proportionally based on ownership percentage, and never try to sell your personal portion to your IRA (or vice versa) down the road.

For example, if your IRA contributes 60% toward a rental property and your personal savings account contributes 40%, all rental income and expenses must be split accordingly – 60% flowing through your IRA and 40% through your personal accounts. This clean separation is absolutely essential for staying compliant with IRS regulations.

How do I handle repairs if my IRA runs low on cash?

This is one of the most common challenges we see investors face. When your IRA-owned property needs unexpected repairs but lacks sufficient funds, you have several options – though none include reaching for your personal checkbook.

You might transfer funds from other retirement accounts you own, or make your annual contribution if you haven’t hit your limit yet. Some investors choose to sell other assets within their IRA to free up cash for urgent repairs.

In more serious situations, your IRA can take out a non-recourse loan against the property to fund repairs, though this will trigger UBTI taxes on a portion of future income. As a last resort, you could take a distribution from your IRA, but you’ll face taxes and potentially early withdrawal penalties.

The approach we most strongly recommend is preventative: maintain healthy cash reserves in your IRA – generally 20-30% of your property’s value – to handle unexpected expenses without scrambling for solutions. This simple strategy has saved our clients countless headaches over the years.

Paying for IRA property repairs from your personal funds is strictly prohibited and could disqualify your entire retirement account – turning a small repair bill into a major financial setback. When in doubt, reach out to your custodian or give us a call before taking action.

Conclusion

Self-directed real estate transactions offer remarkable opportunities whether you’re looking to grow your retirement nest egg or save thousands when buying or selling property. The freedom to control your investments or transactions comes with significant rewards – but also important responsibilities.

Since 2009, we’ve helped hundreds of Coloradans steer these waters successfully. Our clients consistently tell us that the combination of control and targeted support gives them confidence they never thought possible in real estate.

What makes self-direction so powerful is the ability to leverage your own knowledge and expertise. Maybe you’ve spotted a rental property opportunity in an up-and-coming neighborhood that traditional retirement accounts simply don’t offer. Or perhaps you know your home’s value better than anyone and want to maximize your proceeds without paying hefty commissions.

The key is knowing when to go it alone and when to bring in professional help. Even experienced investors benefit from targeted guidance at critical junctures – especially when navigating IRS regulations or preparing legal documents.

Remember these essential takeaways:

Your self-directed IRA offers tremendous investment flexibility, but the rules about who you can transact with are strict and unforgiving. A single prohibited transaction with a family member could disqualify your entire retirement account – a costly mistake we’ve helped many clients avoid.

While non-recourse financing can help you acquire larger properties with your IRA, understanding the resulting tax implications is crucial for accurate financial planning. Those UBTI/UDFI taxes can significantly impact your returns if not properly accounted for.

For homeowners handling their own sales, the potential savings are substantial – our average seller walks away with about $8,000 more than they would using traditional agents. But proper documentation remains essential for legal protection.

At Slice Realty, our lawyer-led approach gives you the best of both worlds: the cost savings of self-direction with the peace of mind that comes from having experienced professionals in your corner. We don’t take over – we empower you with exactly the support you need, when you need it.

Whether you’re diversifying your retirement portfolio or selling your family home, we’re here to help you steer the complexities while maintaining control of your transaction. Our unique combination of legal expertise and real estate knowledge ensures nothing falls through the cracks.

Learn more about our Self-Directed services

Ready to take control of your next real estate move? Let’s talk about how our custom, flat-fee approach can save you thousands while ensuring a smooth, compliant process that meets your specific needs. The freedom of self-direction awaits – with a trusted partner by your side.